Contact Business Continuity

Have questions? Contact the Business Continuity Team!

Contact Us

As a CUSO and cuasterisk.com network partner delivering products and services to 200+ credit unions nation-wide representing more than 2,000 concurrent system users supporting over 1.7 million members, CU*Answers is committed to being there when our customers and owners need us most. Whether it’s the software tools we build and provide that enable credit unions to successfully manage and market their operations or the online banking platforms our members use to reach their financial goals, the expectations are the same. The network and the information it contains must be secure and it must be available.

Core Processing in a 24/7 world

To accomplish this, CU*Answers adheres to strict continuity and recovery principles aligned with industry standards and guidelines, implemented and managed through a robust Business Continuity Management Program. Certified and experienced recovery teams actively monitor daily operations, anticipating incidents and threats with the potential for creating disruptions.

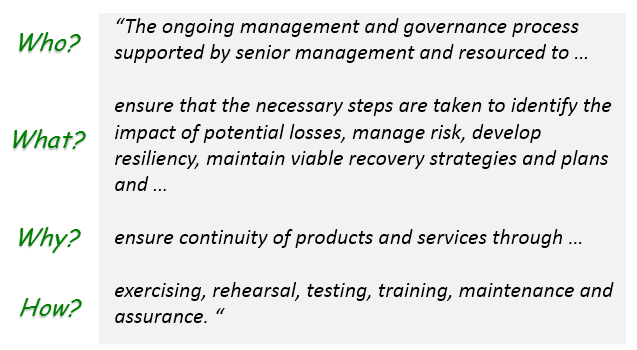

An effective Business Continuity Management program answers the following:

At the heart of the program is a comprehensive written Business Continuity Plan (BCP) developed to maintain or resume business in the event of a disruption. The BCP includes both the technology recovery capability (also known as Disaster Recovery) as well as the recovery of the business units themselves.

Key components of the CU*Answers Business Continuity Plan include:

- High Availability of Systems and Networks between multiple Datacenters

- Disaster Recovery and IT contingency planning

- Auditing and Testing performed regularly with published reports

For questions about the CU*Answers Business Continuity Plan or to request a copy, please contact us.

Business Continuity Planning Process

Keeping the continuity and recovery plans accurate, complete and relevant in a constantly changing and ever increasing complex business and IT environment requires a repeatable process; one that includes the following steps:

-

Needs Assessment and Program Initiation

- Identifies gaps between existing plans and policies and aligns strategies implemented with defined business goals and objectives.

-

Business Impact Analysis and Risk Assessment

- Identifies critical business functions and the threats that warrant the risk of disruption.

-

Continuity and Recovery Strategy Development

- Identifies cost effective controls and procedures to mitigate the likelihood of disruption and the impact to the organization.

-

Recovery Plan Development and Implementation

- Documents the strategies and recovery procedures put in place to continue operations through or recover from disruptions.

-

Plan Awareness and Training

- Educates staff of their roles and responsibilities prior to and during a recovery effort.

-

Plan Exercise, Audit and Maintenance

- Validates accuracy and completeness of the plan and sharpens recovery skills through regular testing.

With defined goals and objective created at the onset, each step identifies key information that helps shape the program resulting in a strategy and plan that is both effective (provides for a timely recovery of critical business functions) and efficient (minimizes losses and allocates limited budget resources for technologies and controls that best address operational risk).

Contact a CU*Answers Certified Continuity Consultant today to learn how you can improve your credit union’s ability to adapt and respond to the next unexpected business disruption.

Creating a “Culture of Continuity”

Having a robust business continuity program requires support and participation at all levels of the organization. The most resilient operations are those that continually educate and train staff for emergency scenarios, effectively creating a “Culture of Continuity”. Culture is the personality, philosophy, attitude, values, and behaviors that define an organization’s style, policies, and working environment.

Culture influences:

- How decisions are made and carried out,

- Resistance to change and innovation,

- Degree of accountability and ownership,

- Organizational strategy, and

- How “things get done”.

At CU*Answers, “Culture of Continuity” is defined as:

“The organizational state of being in which all personnel inherently work to minimize the likelihood of downtime and improve responsiveness and recoverability as we perform day-to-day activities.”

The highlight of the CU*Answers awareness and training program is the annual Continuity Awareness Day with participation from all departments across four facilities.

Read this CUSOMagazine article to learn about our Culture of Continuity.

For the Credit Union

Developing, implementing, and testing continuity and disaster recovery plans can seem an overwhelming task requiring time, resources and skills not always available in every organization. The impact of an outdated plan that is incomplete and no longer relevant puts your organization at risk with the potential for compliance issues, financial loss, member dissatisfaction and damaged reputation.

For more information, see the “Resilient Credit Union”.

The same talent, skills and expertise used to safeguard core-processing for the CU*Answers network is available to you. Our experience in the credit union industry can help guide your business continuity program so that it properly measures up to regulatory requirements (NCUA, FFIEC, etc.), standards and guidelines, peers in the industry, and professional best practices. To accomplish this, we offer the right mix of professional and managed services shown below to complement your exiting program or to help you build one. Contact a CU*Answers Continuity Consultant today to discover in-network solutions that best meet your business objectives.

See what Business Continuity has to offer!

Business Continuity products are now available to order in the store.

Next Steps

CU*Answers offers professional and managed services to help you meet and exceed your recovery objectives. Contact a CU*Answers Continuity Consultant today to discover in-network solutions that best meet your business objectives.

Professional Services available include:

Managed Services available include:

![[The Pulse] HA Rollover Results Now Available](https://www.cuanswers.com/wp-content/uploads/The-Pulse-Disaster-Recovery-email-banner-7.21-300x121.png)