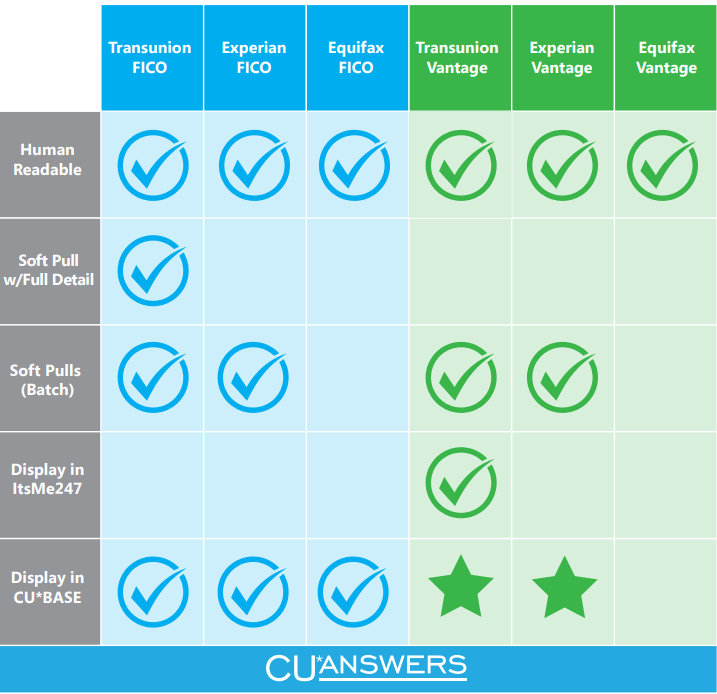

We support all three credit bureaus for both FICO and Vantage scoring models in the human readable format. Soft pulls with full details are only supported by Transunion FICO such as what you would use at membership openings. Soft pulls with full details are a one-time pull on a single member.

We support all three credit bureaus for both FICO and Vantage scoring models in the human readable format. Soft pulls with full details are only supported by Transunion FICO such as what you would use at membership openings. Soft pulls with full details are a one-time pull on a single member.

We also offer a soft pull (batch) service where we update the scores on your entire membership, a specific age rage, or on all accounts with active loans. This is available through Transunion and Experian for both FICO and Vantage. Transunion Vantage scoring models are the only bureau/scoring model that will allow you to post those scores for your members in ItsMe247. All three bureaus for FICO scoring models are available in CU*BASE.

Vantage Scores – How do they differ from other credit scores?

The Vantage Score uses an identical algorithm at all credit bureaus. In other words, the same member would have the same score from one bureau to the next. This is under the assumption that the same data is present at each bureau.

Want to learn more about Vantage? See the CU*Answers Lender*VP Whitepaper.

Credit Score Soft Pulls

Your members, your parameters, your schedule, hassle free!

Why Are They Important?

Bottom line – credit score soft pulls provide current scores, which improves the effectiveness of your lending practices

- Credit score soft pulls increase loan sales to your current and future members

- They grow your loan portfolio without increasing your risk

- They help evaluate loan portfolio risk

What do they have to offer?

Analysis of credit scores is easy in CU*BASE

- Empower your front line staff to offer members the rest rate while also promoting cross sales tasks.

- They provide more information to lending officers even before they begin to sell the loan to the member

Credit Score Soft Pulls with Full Details

What is it?

This is the ability to pull a soft credit score on demand for your members but it gives you the added ability to see the full credit report details just as you would if you were underwriting a loan.

The product is available within CU*BASE today with TransUnion.

When would I use this?

- Account opening

- Portfolio review

- Recurring line of credit reviews