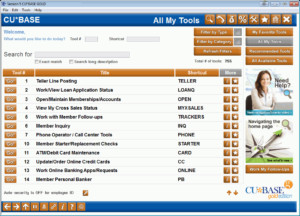

CU*BASE is an independent and wholly-owned data processing software product, supported and maintained by CU*Answers. CU*BASE operates using the IBM i® server platform with TCP/IP connectivity, supporting a variety of LAN/WAN networking solutions.

General

Comprehensive education, online help and reference tools direct to the employee’s desktop via the CU*Answers network

Comprehensive education, online help and reference tools direct to the employee’s desktop via the CU*Answers network- Integrated shared branching options for disaster recovery and expanding member service without brick and mortar

- Flexible, robust configuration options for savings, certificates and loans

- Laser printing options including a complete line of user-defined laser forms: certificate forms, member notices, TIC disclosures and other new account forms, loan and member service denial notices, loan application and officer worksheet, available custom forms programming

- CU control of employee access to Tools

- Expansive selection of customer relationship management features, from analysis dashboards to member marketing tools

Member Services / Front Line

- Teller Cash Dispenser/Recycler integration (

supported TCDs/TCRs)

supported TCDs/TCRs) - Automated funds transfer and check transfers

- Phone software with configurable phone transfer fees

- “New Member” alert comments

- Savings bond redemption tracking

- Safe deposit box tracking

- Laser-printed member starter checks

- IRA beneficiary and payout tracking; automated payout transfers

Lending

- Online credit reports retrieval and storage

- Participation loans tracking

- Complete centralized underwriting system

- Risk-based loan pricing and delinquency analysis tools

- Tools to streamline the loan application process: auto-populated loan applications from the Household database, debt information from on-line credit reports

- Tiered rates based on loan balance

- Collateral title and property tax tracking

- Configurable collections parameters and delinquency analysis tools; online collections monitoring system

- Flexible interest and payment calculation options for business loans, mortgage loans, interest payment only; variable rate and indexed controls

- Lease loan tools

- Indirect (dealer) lending tracking

- Pre-membership loan applications

- LOC disbursement checks

- Online tracking of written-off loans

Accounting / Back Office

CU*Spy online retrieval of reports (90 days) and statements (12 months); CU*Spy CD-ROM archival of reports and statements

CU*Spy online retrieval of reports (90 days) and statements (12 months); CU*Spy CD-ROM archival of reports and statements- Online inquires for easy accrual verification, daily G/L balancing

- Integrated OTB system for online tracking of “off-trial balance” credit cards, loans and savings accounts; automated uploads/downloads with third-party vendors

- CASS certification of member addresses

- Regulatory compliance tools: AIRES downloads, FIDM and OFAC data match systems

- Investment and subsidiary (fixed assets, prepaids, accrued expenses) tracking systems

- Budget creation, analysis and tracking

- Automated check reconciliation

- Loan classification tracking for planning reserves

- Accounts payable tracking

- Streamlined back office monitoring tools: ACH, payroll, share drafts, ATM/debit cards, etc.

- Configurable Reg. D tracking parameters

- Dormancy and escheat monitoring

Marketing and Management Review

Help Desk inquiry for monitoring CU calls to CU*Answers Client Services

Help Desk inquiry for monitoring CU calls to CU*Answers Client Services- Online member survey tracking and analysis

- Cross-sales tracking system, including online marketing tips and product sales procedures

- Telemarketing leads follow-up system

- Tiered Service Levels: automated rewards for member participation

- Marketing Clubs: demographic clubs with automated status tracking, fee waivers and rate benefits

- “Push Marketing” tools including messages via It’s Me 247 Online Banking and CU*Talk Audio Response, email marketing, selective inserts for member statements, and CU-defined statement messages

- Fully-integrated non-member database for non-member relationship tracking and potential member data mining

- Household database and statistical analysis by household and member

- Extensive membership and member participation analysis tools

- Rate forecasting and pricing analysis tools

- Flexible configuration for over-the-counter fees, self-service fees and periodic service charges and rebates: “Relationship Fees”

- ALM downloads

- Membership and new account “reason codes” tracking

- Full line of inquiry tools for comprehensive “window” into CU operations

- Member follow-up ticklers

- SEG/sponsor tracking

- Electronic deposit holds, including the “Member In Good Standing” system for controlling deposit hold settings

![[The Pulse] HA Rollover Results Now Available](https://www.cuanswers.com/wp-content/uploads/The-Pulse-Disaster-Recovery-email-banner-7.21-300x121.png)