CU*BASE Core Processing in a 24/7 world

CU*Answers works very hard to ensure that the products and services we provide for credit unions are online and available when you and your members need them most. While we strive for 24/7 access, due to the nature of the financial services industry and complexity of vendor integrations, there are brief periods when applications need to be taken offline to close out the business day and prepare for the new one. There are also rare occasions when systems and software are upgraded to maintain peak performance, enable new and improved software features, and apply security enhancements to protect your credit union’s data.

CU*Answers works very hard to ensure that the products and services we provide for credit unions are online and available when you and your members need them most. While we strive for 24/7 access, due to the nature of the financial services industry and complexity of vendor integrations, there are brief periods when applications need to be taken offline to close out the business day and prepare for the new one. There are also rare occasions when systems and software are upgraded to maintain peak performance, enable new and improved software features, and apply security enhancements to protect your credit union’s data.

CU*Answers Business Continuity Program

In the sections below, you will see that the CU*BASE core processing platform has been designed with maximum availability in mind.

There are multiple ways in which credit unions and members interact with CU*BASE. For the purpose of this discussion, we’re going to divide them into the following categories and define availability on any given day.

| CU*BASE GOLD | Access to your member database using GOLD software at the credit union. |

|---|---|

| Online/Mobile Banking | Access by members to their account information over the web. |

| CU*TALK/IVR | Access by members to their account information over the phone. |

| ATM/Debit/Credit Cards | Access by members and merchants for the purpose of transactions through EFT vendor integration. |

| Indirect Lending | Access by third-party indirect lending organizations. |

All of the above products (and many more) use CU*BASE as the foundational layer for access to the member database.

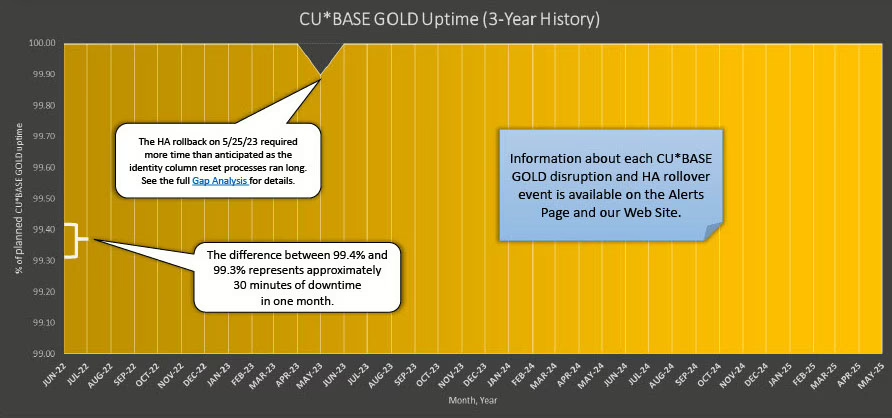

CU*BASE Scheduled Uptime History

The chart below shows the history of CU*BASE core processing uptime outside of the identified exceptions for nightly and weekly processing, software releases, and high availability rollovers. A measurement less than 100% means that an incident occurred that created a disruption to CU*BASE core processing during planned uptime windows.

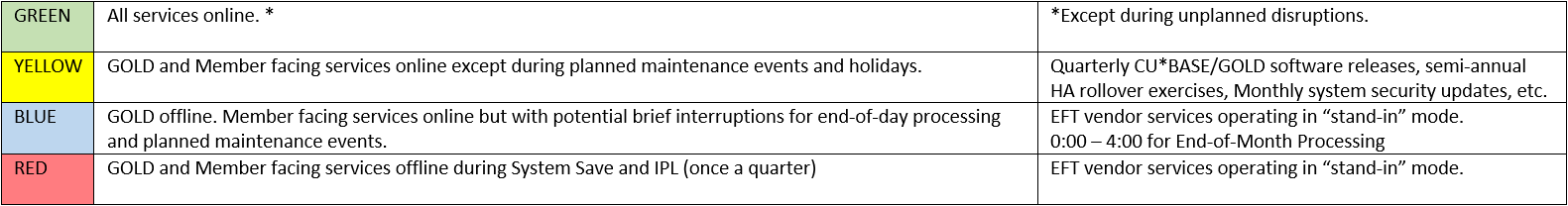

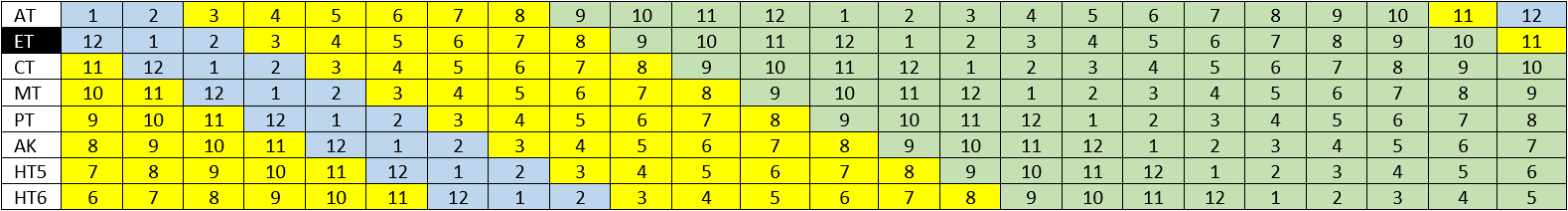

The following key is used for the 24-hour time zone graphs shown:

Nightly Processing (Monday through Saturday)

Planned uptime for core processing services are shown below. Nightly processing to close the books for the business day (EOD) is performed at or shortly after midnight, local time. Credit unions are grouped by time zone but processed individually. All services will remain online with the exception of the few minutes each night during which your credit union is running EOD processing.

- The green hours shown below reflect the window when all services are expected to be online. Exceptions include unplanned interruptions, whether at CU*Answers or one of the integrated vendor services.

- The blue hours shown below reflect the window during which EOD processing will occur (brief interruption for each credit union).

- The yellow hours shown below reflect reflect the window during which any planned maintenance may occur (scheduled and announced in advance).

| CU*BASE GOLD | Online – Brief interruption between 0:00 and 3:00 local time for each credit union EOD processing. |

|---|---|

| Online/Mobile Banking | Online – Stand-in services during EOD processing for each credit union. Brief interruption during transition to/from stand-in processing. |

| CU*TALK/IVR | Online – Stand-in services during EOD processing for each credit union. Brief interruption during transition to/from stand-in processing. |

| ATM/Debit/Credit Cards | Online – Stand-in services during EOD processing for each credit union. Brief interruption during transition to/from stand-in processing. |

| Indirect Lending | Online – Stand-in services during EOD processing for each credit union. Brief interruption during transition to/from stand-in processing. |

Weekly Processing (Sunday)

In addition to the Nightly Processing shown above, a Weekly Full System Save process is performed on the servers that host the CU*BASE application. The red hours below show the window during which this process is scheduled.

| CU*BASE GOLD | Offline – A longer interruption between 4:00 and 6:00 ET for all credit unions during the weekly full system save process. |

|---|---|

| Online/Mobile Banking | Offline – Online/mobile banking applications offline during weekly full system save process. Members presented with a splash page during maintenance period. |

| CU*TALK/IVR | Offline – IVR banking application offline during weekly full system save process. Members presented with an audible message during maintenance period. |

| ATM/Debit/Credit Cards | Online – Stand-in services for EFT vendors during weekly full system save process. |

| Indirect Lending | Offline – Indirection Lending applications are offline during weekly full system save process. |

Planned Interruptions

On occasion, planned maintenance tasks are scheduled, during the yellow hours shown in the graphs above. These maintenance tasks are announced in advance to all credit unions and posted on our Alerts web site. Examples of planned interruptions include:

Network and System Maintenance

On a monthly basis, software and hardware security updates are installed on the systems that host the CU*Answers network information security best practices and policies. These updates typically require system reboots. These reboots are carefully orchestrated to minimize downtime (taking advantage of redundant servers where available).

Other network and system maintenance may include hardware upgrades or repairs as well as configuration changes. All planned maintenance events are schedules during the yellow hours shown in the graphs above and announced to all credit unions in advance.

In the event of a critical security update that is known to be currently exploited in the wild, the decision could be made to perform the installation outside of the normal maintenance windows. These decisions will follow a predetermined process to consider the potential impact to all affected parties and communicated to credit unions in a timely manner.

Software Releases

On a quarterly basis, application updates are published for GOLD and Online/Mobile banking environments. Information about each release, including the release schedule can be viewed at: https://www.cuanswers.com/resources/doc/release-planning/

Multiple announcements about each release are sent to all credit unions in advance.

High-Availability Rollovers

CU*BASE core processing operates on identical redundant systems at both the primary and secondary data centers as part of a high-availability strategy. Data is replicated in real-time. Twice each year, recovery teams conduct a live HA rollover to redirect core processing operations to the secondary data center. CU*BASE production is provided by systems at the secondary data center for 1-3 weeks before teams bring operations back to the primary data center.

Procedures are followed closely during the live rollover events, including multiple checks and audits, to ensure data integrity. The rollover process typically required 90-120 minutes to complete and are scheduled during the yellow hours shown in the graphs above. The rollover schedule is announced in advance to all credit unions and can be viewed below.

More information about the CU*Answers Business Continuity program including reports from recent rollover and recovery events can be viewed at: https://www.cuanswers.com/solutions/business-continuity/auditing-and-testing/.

Rollover Exercises

| Scheduled Dates | Rollover to HA | Rollback to Production |

|---|---|---|

| March 9-16, 2025 | 3/09 3:00 am ET | 3/16 3:00 am ET |

| September 15-22, 2024 | 9/15 3:00 am ET | 9/22 3:00 am ET |

| March 10-17, 2024 | 3/10 1:00 am ET | 4/07 3:00 am ET |

| September 17-20, 2023 | 9/17 2:00 am ET | 9/20 4:30 am ET |

| May 14-21, 2023 | 5/14 2:00 am ET | 5/21 2:00 am ET |

| December 20-23, 2022 | 12/20 11:45 am ET | 12/23 3:45 am ET |

| July 10-24, 2022 | 7/10 3:00 am ET | 7/24 3:00 am ET |

Unplanned Interruptions

On rare occasions, systems and networks experience outages that may result in unplanned interruptions for one or more services.

As part of the Strategic Technology Plan, CU*Answers has invested in redundant components where feasible. Often, the disruption is generated by an outage at one of many integrated vendor networks. Information about the interruption, including the expected recovery time, is communicated to all credit unions impacted through announcement and posted on our Alert web site.