Looking for news about other lending projects?

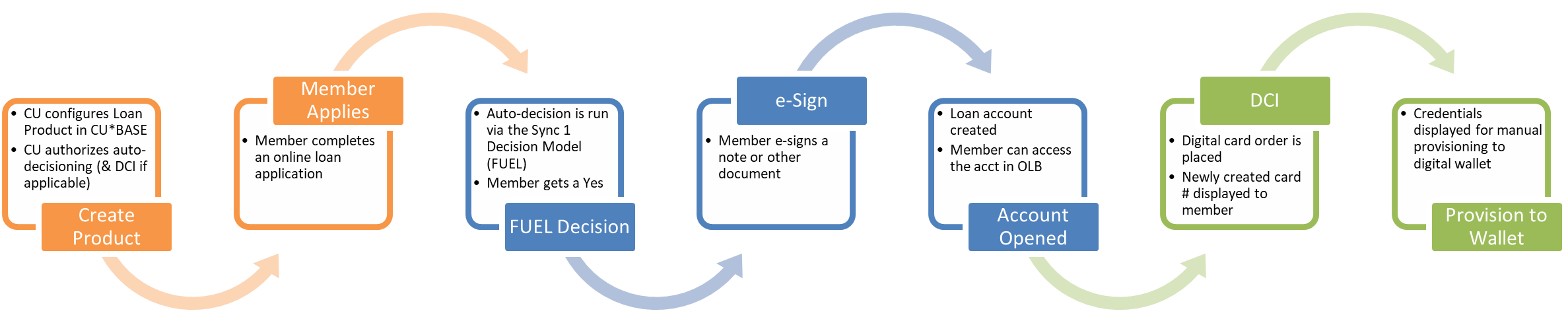

This project combines the mechanisms created for 1Click Loan Offers with a new online loan application UI to allow for auto-approval & fulfillment of closed-end signature loans, unsecured LOCs, and credit cards. Starting with a new, streamlined application being built as part of the online LOS initiative, an authenticated member would be able to apply for a credit card or unsecured loan via the online banking rate board, and when the app was submitted the system would immediately run it through the FUEL Decision Model via Sync 1. If approved, the online LOS would automatically present documents for e-signature and open the account, using the 1Click Loan Offers flow and infrastructure.

Although the behind-the-scenes mechanisms would be borrowed from 1Click, these would still be separate from 1Click offers in that a different configuration would come into play. These apps would still require a member to apply for the loan, as opposed to the credit union creating a list of pre-approved accounts to which an offer would be presented. A CU would not need to set up 1Click offers in order to use the auto-approval and fulfillment flow. But if a form was programmed for use with 1Click offers, that same form could be plugged into the config for a loan product set up for auto-approval & fulfillment.

In fact, a combination of both 1Click offers and the more traditional loan app flow will give credit unions wider reach than just one or the other channel would by itself. Some members might be missed in an batch offer but would still be eligible to get a loan should they apply.

And to put the cherry on top, once the separate Digital Card Issuance project is completed, DCI will also be integrated into the 1Click Credit Card Offers flow so that the member would automatically receive a digital card # and the order for a plastic placed by the system with no employee intervention needed.

Status as of December 2023: Product design is coming along but we are dependent on pieces and parts from other projects that are still in development, so design work will continue for a while yet.

Your chef for this recipe: Dawn Moore

Can’t wait until this product is LIVE. This will be a great way to service our members loan needs 24 hours a day. Please put a rush on this project. Thanks.

Thanks for the affirmation, Greg! We’re plugging away – there are some dominoes that need to fall first, including our new online app (some news on this at the Leadership Conference!), some enhancements to the FUEL decision model, and even work on the Digital Card Issuance front so that members can immediately get a card number for their digital wallet. In the meantime, CUs can start getting ready by reviewing their policies and procedures in preparation for auto-approvals. What will it take for you to be confident in the computer saying YES to your members on your behalf, in the middle of the night?